Research Payments

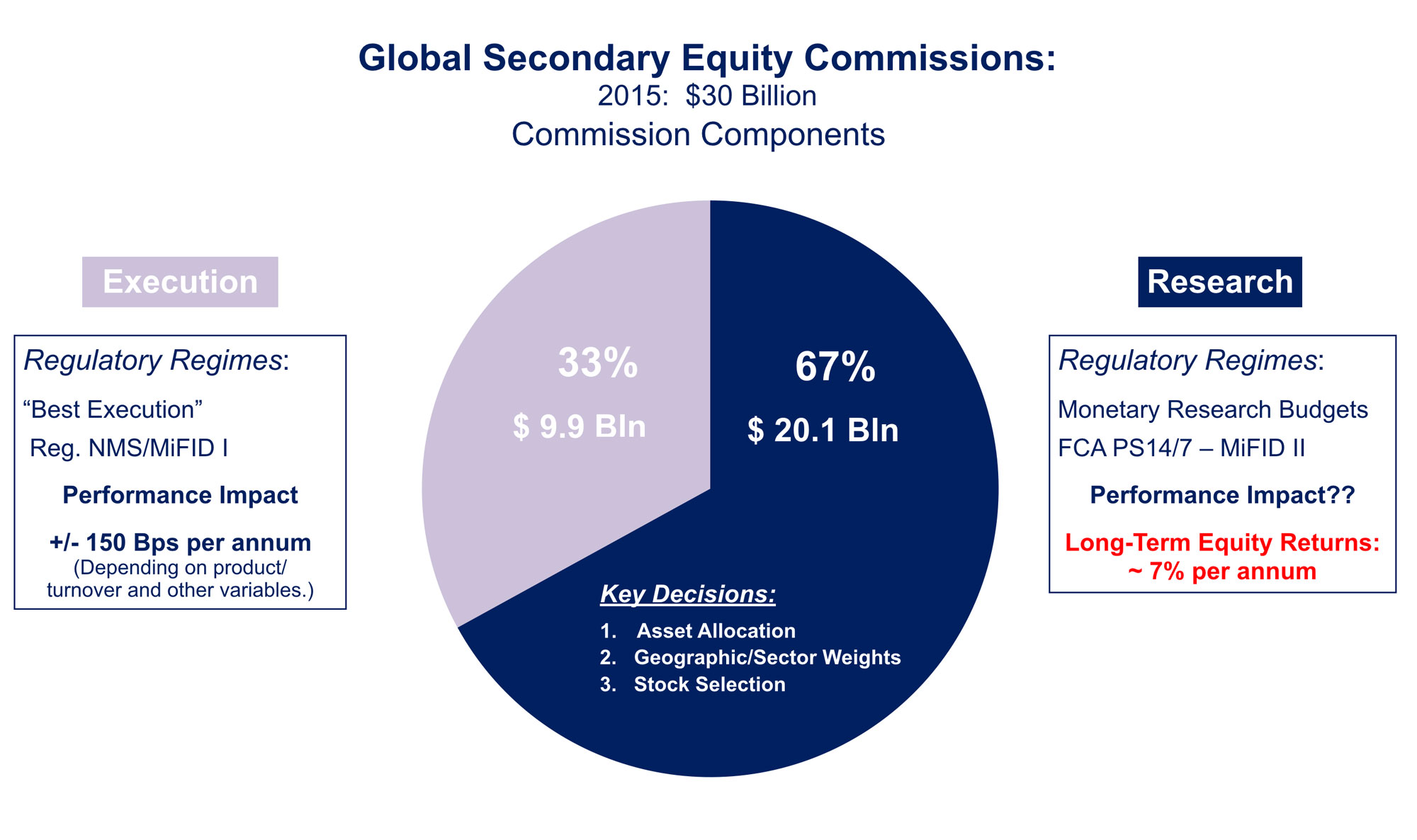

Regulations requiring commission unbundling will force asset managers to separate research and execution payments. Based on European CSA data, and prevailing execution-only rates, the global estimated commission split is represented here:Research commission spending likely represents the greater part of investment returns for most equity strategies.

Evolution of the Research Payment Model

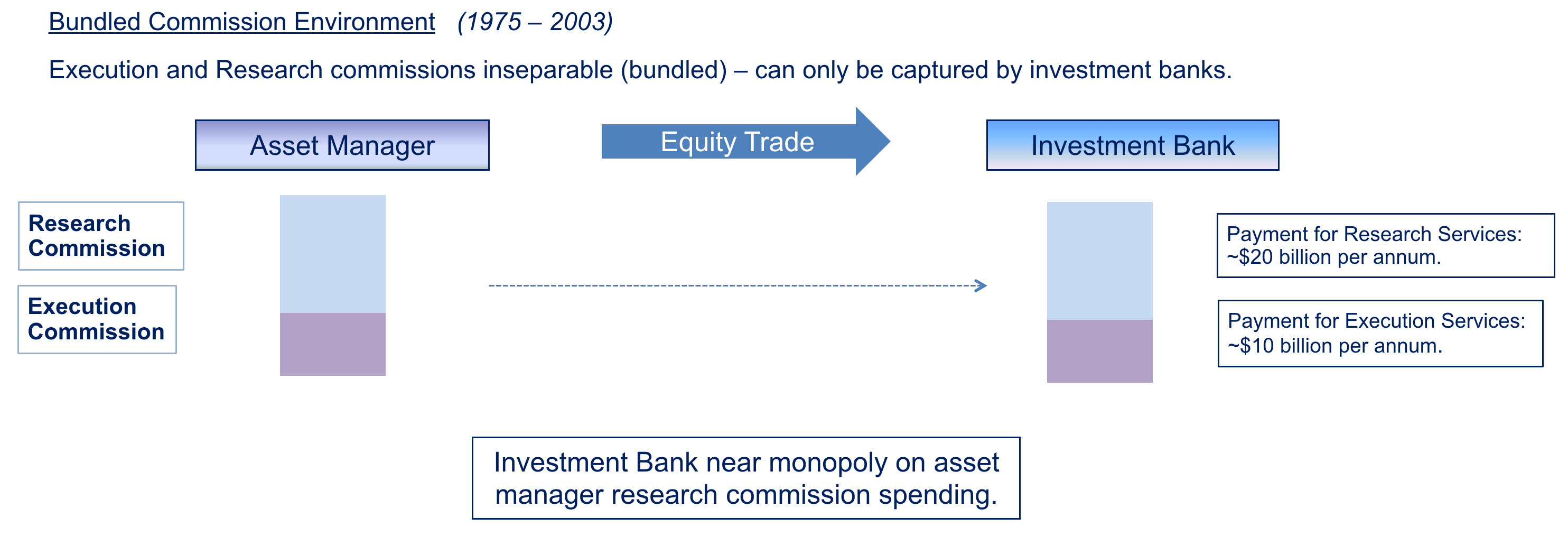

In the “bundled” model, payment for the research required an equity execution relationship with every (brokerage or bank) research producer. “Best Execution” requirements included in Reg. NMS (US) and MiFID I (Europe) challenged this notion. The research and execution capabilities of banks varied - it was unlikely that all research counter-parties could provide “best execution”.

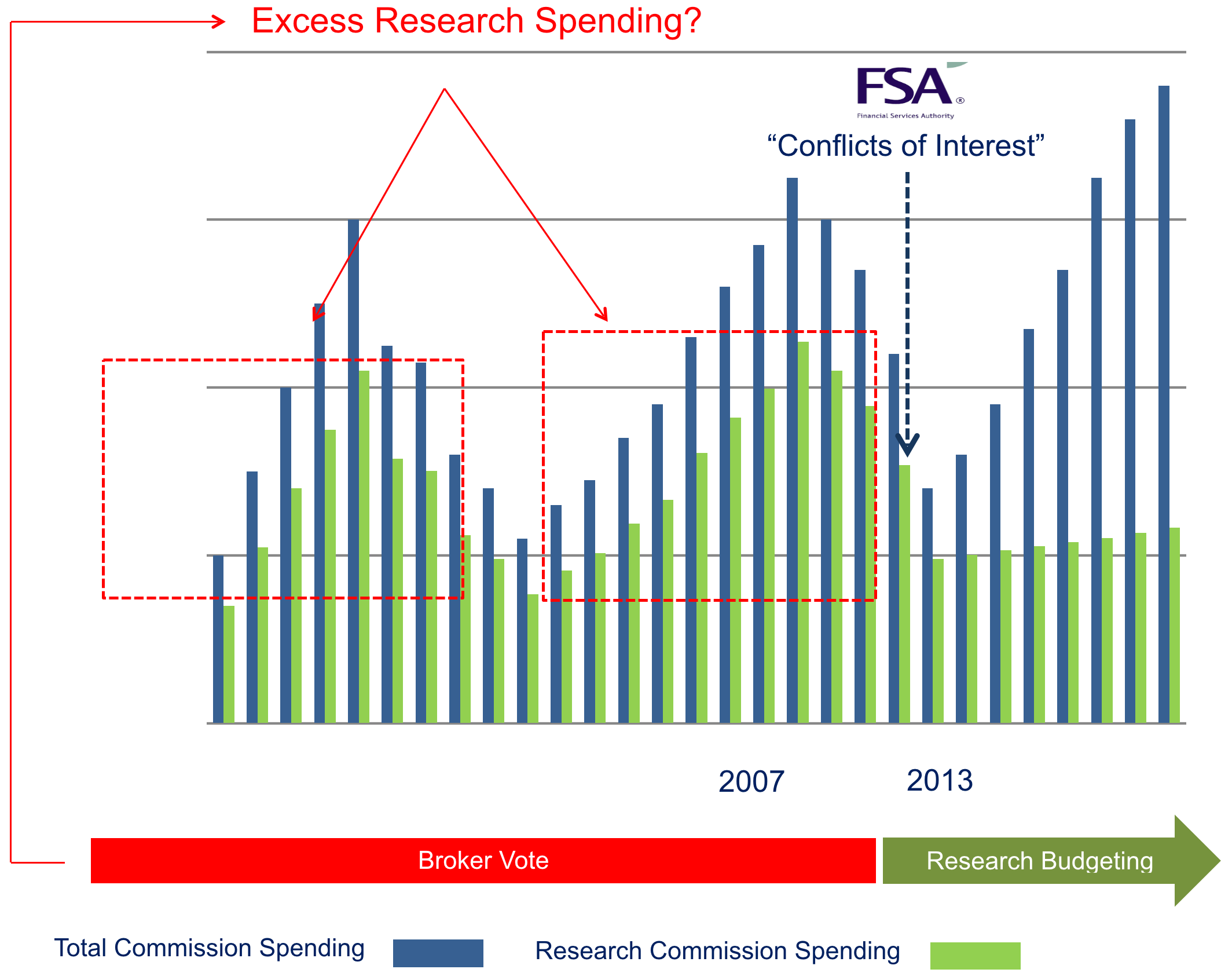

Another feature of the bundled model was that research payments were linked to execution levels. In ad valorum commission markets (those outside the US) - this meant that as volumes, AUM and-or share prices rose, research payments could increase significantly for similar research services being purchased from year to year.

This potentially reduced returns to end investors, who funded the research commission spending. (Commissions are deducted from returns). The UK FSA and EMSA in Europe via MiFID II both require the separation of research and execution payments to control theoretically unlimited research commission spending. Asset managers are required to establish ex-ante monetary research budgets rather than broker vote research commission allocations.

Commission Schematic

In the research budgeting environment spending is likely to be far less cyclical. (2013 on in the UK). More precise research payments are possible through the unbundled commission mechanism.

Unbundled Commission Environment (2003 Onward)

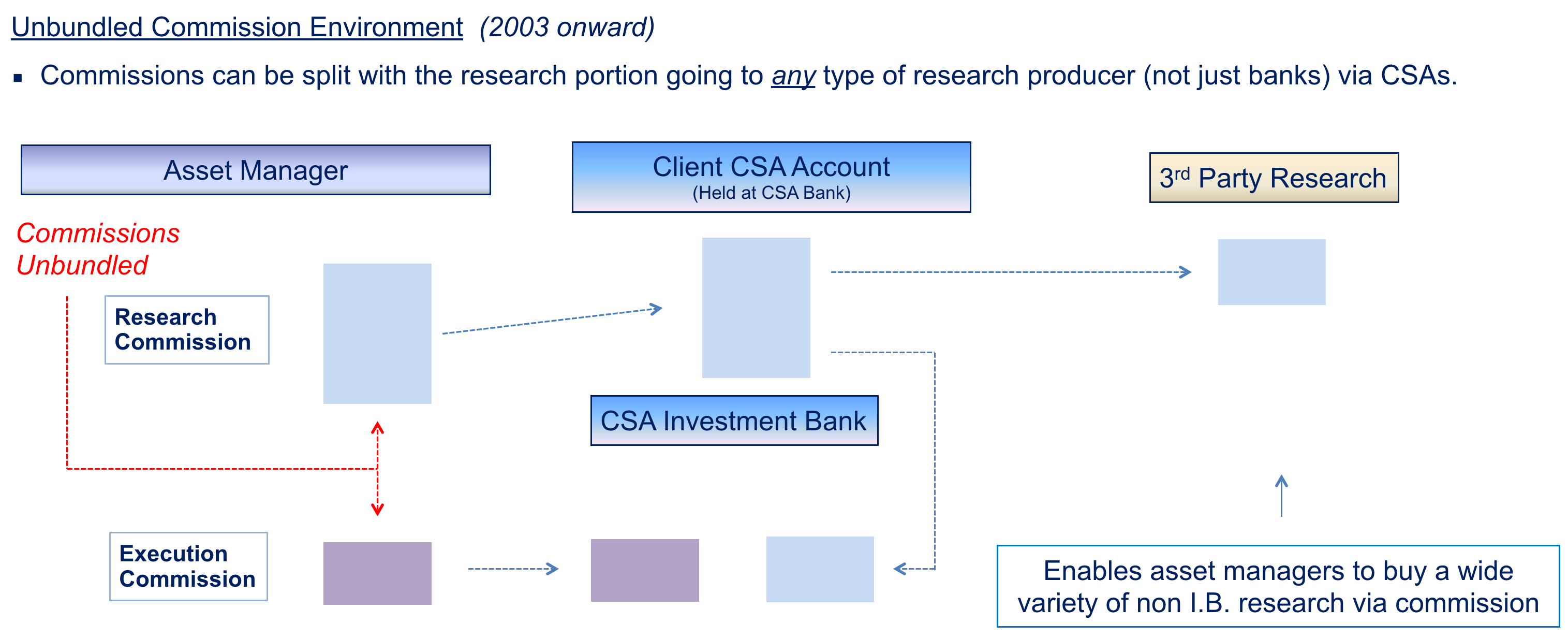

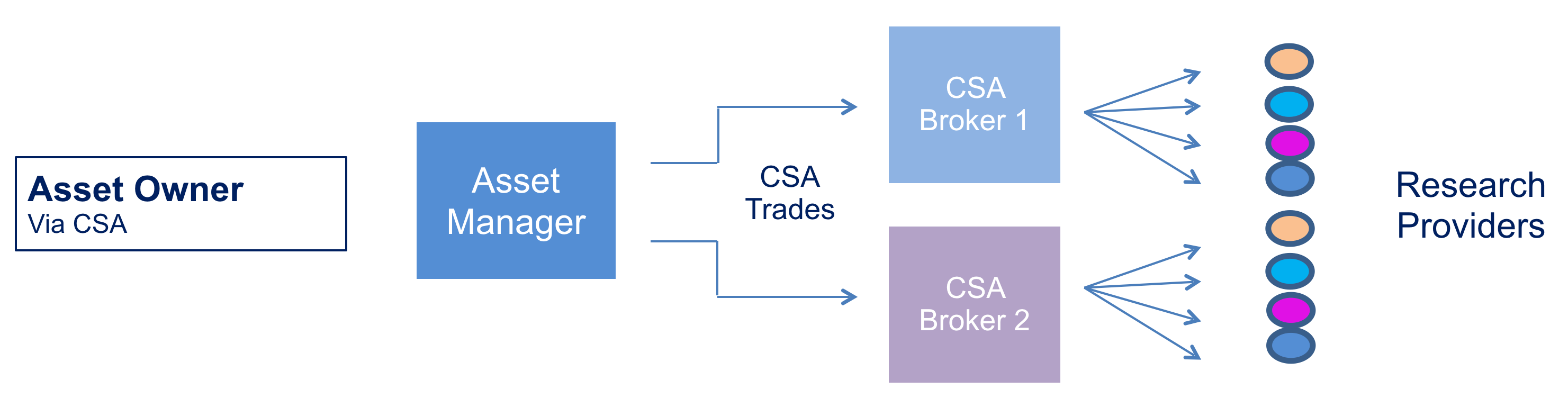

Commissions can be split with the research portion going to any type of research producer (not just banks) via CSAs.

CSAs are widely used in the UK, the US and parts of continental Europe. Many asset managers appreciate the additional control and transparency of research spending that CSAs can deliver. This also moves asset managers in the direction of monetary research budgets. In order to make a CSA payment to an investment bank research provider (with unpriced research), the manager must decide what research services they are buying from the manufacturer and what those services are worth in order to instruct the payment.

Current CSA Payment Process

Under MiFID II, there will be three primary ways that asset managers can pay for research.

The asset manager can pay for research out of its own P&L. This may not be a preferred option for many managers as it will reduce their profit margins versus using client commissions. Because client funds are not used for research purchases, there is no regulatory requirement for a monetary research budget. However, in practice, as is the asset manager’s own funds that are being used, there will likely be significant management scrutiny over research spending.

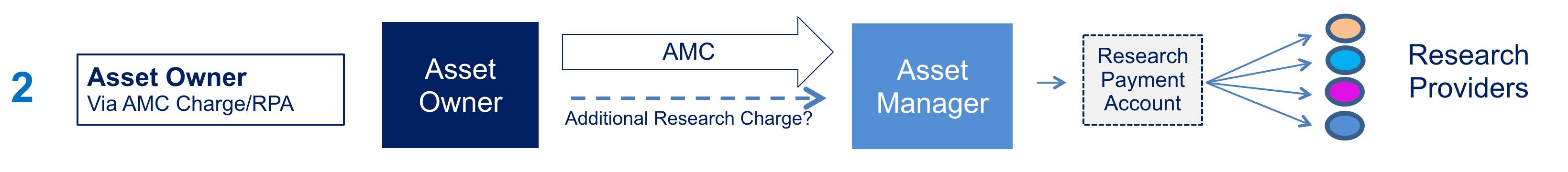

Research Payment Accounts

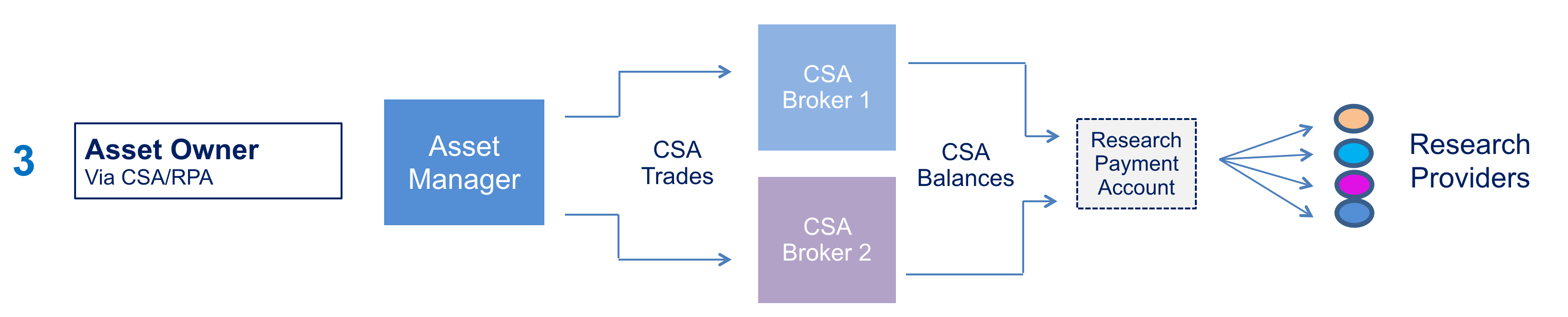

Under MiFID II, if client (asset owner) funds are being used to purchase research, asset managers must construct monetary research budgets and make all research payments via a Research Payment Account (RPA). This is a separate account, controlled directly by the asset manager or its agent. In the current CSA model, the CSA banks make the research payments on the instruction of the asset manager. In future the RPA will make the payments.

In option 2, the asset owner is making the research payments by providing additional (specified research funding to the asset manager’s RPA). This requires that asset manager to request additional funds and for the asset owner to agree. In the so-called “Swedish Model” an agreed research charge is deducted fro the fund on an accrual basis and transferred to the RPA. (This obviously requires a monetary research budget). Some managers may be reluctant to ask asset owners for specific additional research funding as it would require a change in operational processes for both parties.

Based upon the December version of the MiFID II draft, it appears that the current CSA system can be used as a collection mechanism to fund RPAs. This has the advantage of being an existent process at least for managers (and their clients) currently using CSAs. For managers that are still operating a bundled commission model, this ill require significant change. Under MiFID II, virtually the only way that commissions can be used to fund research purchases will be via CSAs funding RPAs. Ex-ante monetary research budgets will be required as client funds (via commission) are being used.

MiFID II will require “bundled” managers to establish both CSA relationships (with banks) and RPAs if they wish to use commissions to fund research.